The Irish Government’s Budget 2025 once again favours electric vehicles regarding the BIK regime for employees.

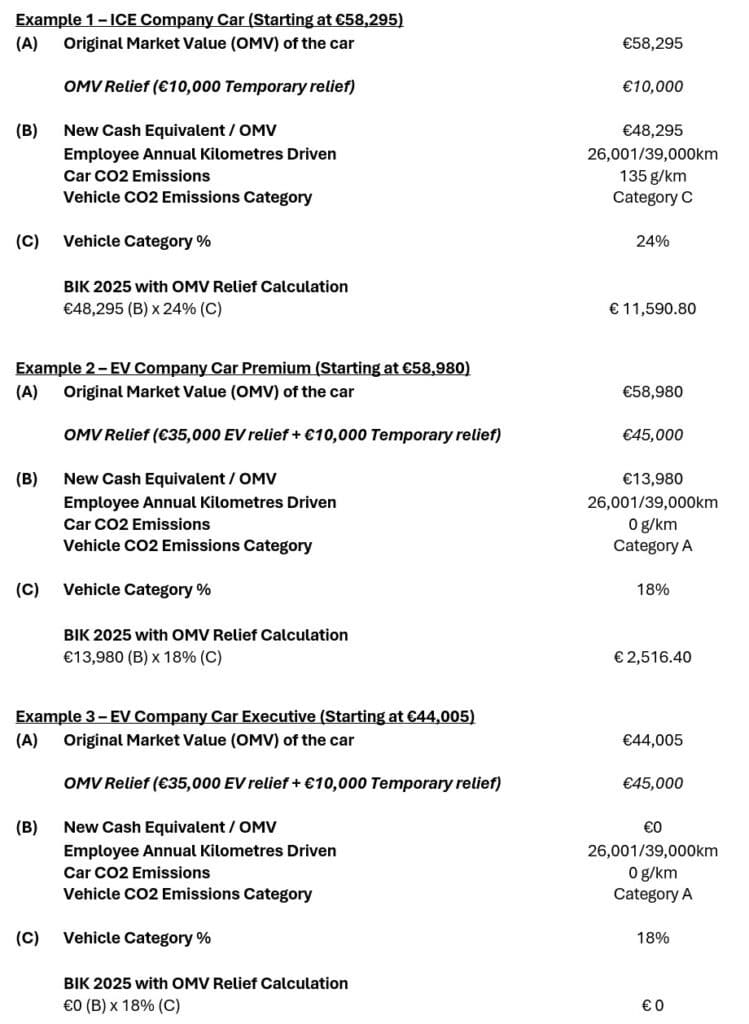

Here, we look at how benefit-in-kind was affected in Budget 2025 and include an example calculation of the cost implications of OMV relief for EV company cars versus a comparable ICE vehicle.

Yesterday (Tuesday, October 1st, 2024), Minister for Finance Jack Chambers announced the continuation of EV BIK Relief. The €10,000 BIK exemption for electric vehicles will be extended until 2026.

The overall BIK relief of €45,000 for Electric Vehicles in 2025 will comprise the €35,000 electric vehicle-specific relief (already in legislation) plus the additional temporary universal relief of €10,000.

The exemption cap will gradually reduce over the next few years, with the extra €10,000 BIK exemption expected to be removed entirely by the end of 2025.

The total deduction for electric vehicles in 2025 currently stands at €45,000, followed by an expected reduction to €20,000 in 2026 and €10,000 in 2027.

There were no significant changes to traditional vehicle BIK rates. The rates remain based on CO2 emissions, with higher-emission vehicles incurring higher tax rates, aligning with environmental goals.

We have included an example calculation below of the cost implications of the OMV relief for electric company cars (Premium and Executive models) versus a diesel ICE car.

For more insights on BIK and its impact on your business, visit:

Use the form below to contact Mahony Fleet and learn how your company can move to an EV fleet for your employees.