When acquiring vehicles, fleet managers often have to decide whether to lease or purchase outright.

This article explores the differences between car leasing and van leasing through Mahony Fleet versus purchasing outright, and why leasing is often the preferred option for customers.

Ownership and Asset Management

Leasing: Corporate businesses leasing cars and vans do not take ownership responsibilities of the vehicles. Instead, they pay for fleet use over an agreed term, typically 2-5 years. Leasing allows businesses to upgrade their fleet regularly, ensuring they always have access to modern, efficient vehicles.

Mahony Fleet retains ownership, meaning your business does not bear the asset management burden, including vehicle depreciation.

Purchasing: When purchasing vehicles outright, businesses own the assets and are responsible for their management. This includes maintenance, tax, depreciation, and, ultimately, the sale or disposal of the vehicles.

While purchasing provides ownership, it ties up capital in depreciating assets, limiting a company’s financial flexibility.

Upfront Costs

Leasing: One significant advantage for businesses leasing cars and vans through Mahony Fleet is the lower upfront cost compared to purchasing. Typically, a lease requires an initial payment (often equivalent to one or two month’s rent), followed by fixed monthly payments.

Leasing allows businesses to allocate capital more efficiently, especially in industries where vehicle fleets are critical but not the company’s core focus.

Purchasing: Purchasing vehicles outright requires a significant upfront investment, which can be financially restrictive for businesses looking to preserve capital.

While financing is an option, it often involves higher monthly repayments than leasing, and interest on loans can add to the total cost of ownership (TCO).

Monthly Payments and Budget Predictability

Leasing: Mahony Fleet’s car leasing and van leasing agreements offer predictable monthly payments, typically including additional services such as maintenance, insurance, and road tax.

This eliminates unexpected costs and makes budgeting easier for corporate buyers. Businesses know what they will pay monthly, allowing for more accurate financial planning and forecasting.

Purchasing: Monthly costs are typically higher if financing is involved, and these payments may vary based on interest rates and loan terms. Additionally, businesses must budget for fluctuating expenses related to vehicle maintenance, road tax, and unexpected repairs, which can complicate future planning.

Depreciation and Residual Value Risk

Leasing: One of the most significant financial benefits of car leasing and van leasing through Mahony Fleet is that businesses are not responsible for the vehicle’s depreciation. Depreciation is particularly concerning for fleet managers as vehicles lose value rapidly, especially in the first few years.

With leasing, Mahony Fleet absorbs the depreciation risk, and businesses return the vehicles at the end of the lease term. Leasing enables companies to continually operate a fleet of newer, more efficient cars and vans without the financial burden of asset devaluation.

Purchasing: When a business purchases vehicles outright, it assumes full responsibility for their depreciation.

The fleet’s resale value will decrease significantly over time, and this lost value represents a direct financial loss to the company. Businesses must manage the disposal of older vehicles, which can be time-consuming and financially inefficient.

Fleet Flexibility

Leasing: Corporate businesses benefit from the flexibility of leasing cars and vans. Mahony Fleet offers tailored leasing solutions, allowing companies to scale their fleet up or down based on changing operational needs.

For instance, if a business expands and requires additional vehicles, leasing makes adding more vehicles to the fleet easy without the financial strain of purchasing. At the same time, businesses can easily upgrade to newer models at the end of each lease term, ensuring their fleet remains modern and efficient.

Purchasing: While ownership allows a company to keep vehicles for as long as it desires, replacing or expanding a fleet is more complex. Selling old vehicles and purchasing new ones can be costly and time-consuming, limiting a business’s ability to adapt quickly to changes in demand.

Benefits of Leasing Through Mahony Fleet for Corporate Buyers

Improved Cash Flow

Leasing a fleet through Mahony Fleet allows businesses to conserve capital. By avoiding the significant upfront costs of vehicle purchases, companies can direct their capital towards growth, innovation, or other core business functions.

The predictable monthly payments associated with leasing also improve cash flow management, as you will know precisely what you will be paying without worrying about unexpected vehicle-related expenses.

Reduced Administrative Burden

Mahony Fleet’s leasing packages include comprehensive maintenance, road tax, and breakdown assistance. For fleet managers, this means a significant reduction in the administrative burden associated with fleet management.

Instead of coordinating multiple service providers and handling unexpected repairs, fleet managers can rely on Mahony Fleet to manage these aspects, allowing them to focus on their core business activities.

Access to Newer, More Efficient Vehicles

Leasing allows businesses to operate a fleet of the latest models without the financial burden of frequent vehicle purchases.

Newer vehicles tend to be more fuel-efficient, environmentally friendly, and equipped with the latest safety and technological features.

This enhances operational efficiency and improves corporate image for most businesses, particularly for companies with customer-facing vehicles.

Flexibility in Contract Terms

Mahony Fleet provides flexible leasing agreements tailored to the specific needs of corporate clients. Businesses can select the lease term, mileage limits, and maintenance options that best suit their operational needs.

This flexibility ensures that businesses are not locked into contracts that don’t align with their fleet usage, giving them greater control over their fleet management strategy.

Enhanced Fleet Management

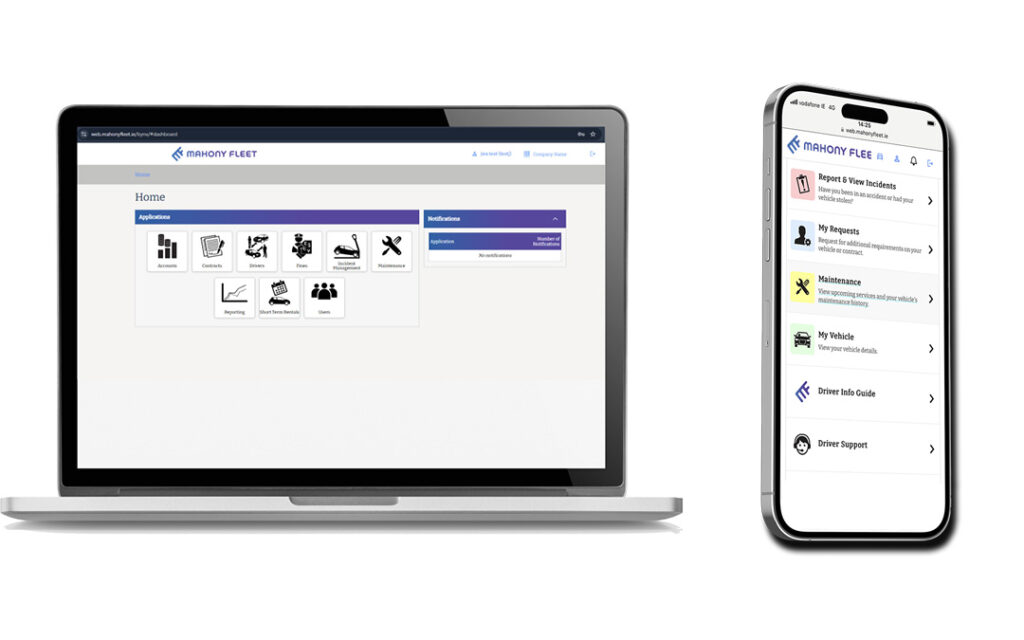

Leasing through Mahony Fleet also provides access to advanced fleet management services like the Mahony Fleet Portal and Driver’s App. For businesses with larger fleets, the Mahony Fleet Portal can assist in optimising fleet performance, monitoring vehicle usage, and ensuring that vehicles are maintained at optimal levels.

This professional support ensures that businesses can maximise the efficiency of their fleet operations while minimising downtime.

Why Should Corporate Buyers Should Consider Leasing with Mahony Fleet?

For businesses, especially those managing large vehicle fleets, leasing through Mahony Fleet offers significant advantages over purchasing outright.

Leasing provides cost predictability, reduced financial risk, and access to modern, efficient vehicles.

By shifting the burden of depreciation, maintenance, and asset management to Mahony Fleet, businesses can focus on their core operations while enjoying the flexibility of a tailored fleet solution.

Leasing through Mahony Fleet is ideal for corporate fleet managers who want to streamline operations, reduce costs, and maintain a modern fleet.

The only thing left to do is contact one of our leasing experts, who will be happy to discuss your options and offer a bespoke leasing agreement.

Whether you are looking for one car or one hundred vans, Mahony Fleet works with all sizes of Irish and European businesses looking to get their fleets on the road. Use the link below to contact Mahony Fleet today.